A Contrastive Deep Learning Approach to Cryptocurrency Portfolio with US Treasuries

DOI:

https://doi.org/10.5281/zenodo.13357988ARK:

https://n2t.net/ark:/40704/JCTAM.v1n3a01References:

20Keywords:

Cryptocurrency, Supervised Learning, Digital Asset, Bitcoin, Ethereum, Litecoin, Machine Learning, Crypto, Contrastive LearningAbstract

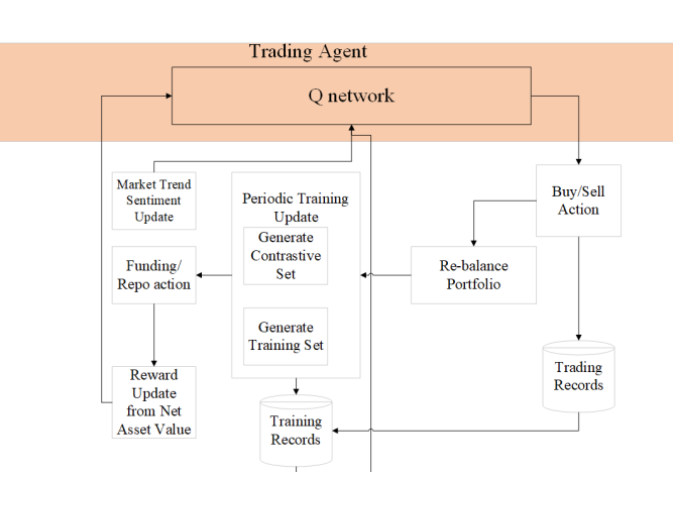

To enhance the portfolio performance of cryptocurrency and US treasuries, we introduce a pioneer approach that incorporates contrastive learning to traditional deep learning techniques. The contrastive learning process builds a contrary learning input whenever a market moves, or trader action is performed to enhance the learning supervision. We leverage contrastive learning with both Deep-Q Learning and Proximal Policy Optimization. The result shows promising performance in both downward and upward market environments.

References

Q. Y. E. Lim, Q. Cao and C. Quek, "Dynamic portfolio rebalancing through reinforcement learning," Neural Computing and Applications, December 2021.

E. Chen, M. Ma and Z. Nie, "Perpetual future contracts in centralized and decentralized exchanges: Mechanism and traders’ behavior," Electronic Markets, vol. 34, June 2024.

Y.-S. Ren, C.-Q. Ma, X.-L. Kong, K. Baltas and Q. Zureigat, "Past, present, and future of the application of machine learning in cryptocurrency research," Research in International Business and Finance, vol. 63, p. 101799, December 2022.

H. Sebastião and P. Godinho, "Forecasting and trading cryptocurrencies with machine learning under changing market conditions," Financial Innovation, vol. 7, January 2021.

H. Ni, S. Meng, X. Geng, P. Li, Z. Li, X. Chen, X. Wang and S. Zhang, "Time Series Modeling for Heart Rate Prediction: From ARIMA to Transformers," arXiv preprint arXiv:2406.12199, 2024.

X. Li, J. Chang, T. Li, W. Fan, Y. Ma and H. Ni, "A Vehicle Classification Method Based on Machine Learning," Preprints, 2024.

X. Li, Y. Yang, Y. Yuan, Y. Ma, Y. Huang and H. Ni, "Intelligent Vehicle Classification System Based on Deep Learning and Multi-Sensor Fusion," Preprints, July 2024.

G. Lucarelli and M. Borrotti, "A deep Q-learning portfolio management framework for the cryptocurrency market," Neural Computing and Applications, vol. 32, September 2020.

L. Weng, X. Sun, M. Xia, J. Liu and Y. Xu, "Portfolio trading system of digital currencies: A deep reinforcement learning with multidimensional attention gating mechanism," Neurocomputing, vol. 402, pp. 171-182, August 2020.

Y. Li, P. Hu, Z. Liu, D. Peng, J. T. Zhou and X. Peng, "Contrastive Clustering," Proceedings of the AAAI Conference on Artificial Intelligence, vol. 35, pp. 8547-8555, May 2021.

Y. Li, S. Jiang, Y. Wei and S. Wang, "Take Bitcoin into your portfolio: a novel ensemble portfolio optimization framework for broad commodity assets," Financial Innovation, vol. 7, August 2021.

Z. Jiang and J. Liang, "Cryptocurrency portfolio management with deep reinforcement learning," 2017 Intelligent Systems Conference (IntelliSys), September 2017.

Z. Qi, D. Ma, J. Xu, A. Xiang and H. Qu, "Improved YOLOv5 Based on Attention Mechanism and FasterNet for Foreign Object Detection on Railway and Airway tracks," 2024. [Online]. Available: https://arxiv.org/abs/2403.08499.

A. Xiang, B. Huang, X. Guo, H. Yang and T. Zheng, "A Neural Matrix Decomposition Recommender System Model based on the Multimodal Large Language Model," 2024. [Online]. Available: https://arxiv.org/abs/2407.08942.

W. Zhu and T. Hu, "Twitter Sentiment analysis of covid vaccines," in 2021 5th International Conference on Artificial Intelligence and Virtual Reality (AIVR), 2021.

Y. Wang, J. Zhao and Y. Lawryshyn, "GPT-Signal: Generative AI for Semi-automated Feature Engineering in the Alpha Research Process," in Proceedings of the Eighth Financial Technology and Natural Language Processing and the 1st Agent AI for Scenario Planning, Jeju, 2024.

S. D’Amico and N. A. Pancost, "Special Repo Rates and the Cross-Section of Bond Prices: The Role of the Special Collateral Risk Premium," Review of Finance, vol. 26, October 2021.

P. Srivastava and S. S. Mazhar, "Comparative Analysis of Sharpe and Sortino Ratio with reference to Top Ten Banking and Finance Sector Mutual Funds," International Journal of Management Studies, vol. V, p. 93, October 2018.

U. D. o. t. Treasury, "Daily Treasury Par Yield Curve Rates," [Online]. Available: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/. [Accessed 11 8 2024].

"Historical performance of the Bitcoin index," Backtest by CURVO, [Online]. Available: https://curvo.eu/backtest/en/market-index/bitcoin. [Accessed 11 8 2024].

Downloads

Published

How to Cite

Issue

Section

ARK

License

Copyright (c) 2024 The author retains copyright and grants the journal the right of first publication.

This work is licensed under a Creative Commons Attribution 4.0 International License.