Funding-Rate Driven Routing in Financial Prediction Systems

DOI:

https://doi.org/10.70393/6a6374616d.333332ARK:

https://n2t.net/ark:/40704/JCTAM.v2n6a05Disciplines:

Big Data TechnologySubjects:

Data AnalyticsReferences:

10Keywords:

Funding Rate, LSTM, Deep Learning, Edge–Cloud ExecutionAbstract

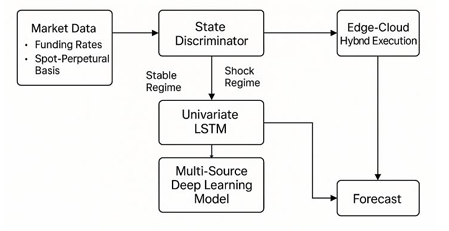

Financial forecasting models tend to be based on past market action trends. While such methods are very good under steady-state conditions, financial markets tend to change abruptly due to a change in liquidity, macroeconomic news, or leverage imbalances. Such models trained on past price action are too sluggish in responding to regime changes and therefore make the wrong and not to be relied upon predictions at the worst possible moment when accurate advice is most required. To address this challenge, this paper proposes a funding-rate driven routing model that dynamically switches between forecasting models depending on inferred market states. Funding rates and spot–perpetual basis signs are used to detect volatility and sentiment changes that cause shock regimes. In ordinary times, a light univariate LSTM is used to ensure forecasting efficacy. As volatility rises, the system pushes forecasting to a multi-source deep learning model that incorporates price, volume, and sentiment background. The architecture uses an edge–cloud hybrid execution strategy that compromises on latency, privacy, and scalability. This work demonstrates that, through the integration of regime detection and model switching, one can obtain more accurate forecasting without sacrificing computational responsibility. The model introduces an additional more adaptive, context-aware methodology for real-world financial forecasting environments that must operate under continuously varying risk levels.

References

[1] Qi, R., & Hu, L. (2025). Stock Price Prediction of Apple Inc. Based on LSTM Model: An Application of Artificial Intelligence in Individual Stock Analysis. European Journal of AI, Computing & Informatics, 1(3), 1-9.

[2] Hu, L. (2025). Hybrid Edge-AI Framework for Intelligent Mobile Applications: Leveraging Large Language Models for On-device Contextual Assistance and Code-Aware Automation. Journal of Industrial Engineering and Applied Science, 3(3), 10-22.

[3] Hu, L., Wu, Q., & Qi, R. (2025). Empowering smart app development with SolidGPT: an edge–cloud hybrid AI agent framework. Advances in Engineering Innovation, 16(7), 86-92.

[4] Qi, Ruoyu. "Research on the Application of Robo-Advisory Systems in Personal Wealth Management: A Case Study of Middle-Class Households in the United States." Economics and Management Innovation 2.4 (2025): 46-55.

[5] Qi, Ruoyu. "Loan Default Prediction and Feature Importance Analysis Based on the XGBoost Model." European Journal of Business, Economics & Management 1.2 (2025): 141-149.

[6] Qi, Ruoyu. "An Empirical Study on Credit Risk Assessment Using Machine Learning: Evidence from the Kaggle Credit Card Fraud Detection Dataset." Journal of Computer, Signal, and System Research 2.5 (2025): 48-64.

[7] Galema, R., Koetter, M., & Liesegang, C. (2016). Lend global, fund local? Price and funding cost margins in multinational banking. Review of Finance, 20(5), 1981-2014.

[8] Gross, M. M., & Siebenbrunner, C. (2019). Money creation in fiat and digital currency systems. International Monetary Fund.

[9] Akcay, Ü., & Güngen, A. R. (2019). The making of Turkey's 2018-2019 economic crisis (No. 120/2019). Working Paper.

[10] Jansen, M., Nguyen, H. Q., & Shams, A. (2025). Rise of the machines: The impact of automated underwriting. Management Science, 71(2), 955-975.

Downloads

Published

How to Cite

Issue

Section

ARK

License

Copyright (c) 2025 The author retains copyright and grants the journal the right of first publication.

This work is licensed under a Creative Commons Attribution 4.0 International License.