Evaluating Regression and Ensemble Models for Financial Forecasting: The Case of Apple Stock

DOI:

https://doi.org/10.5281/zenodo.13821480ARK:

https://n2t.net/ark:/40704/JIEAS.v2n5a01References:

18Keywords:

Stock Prediction, Machine Learning, SVM, Random Forest, Ensemble ModelAbstract

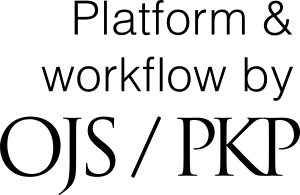

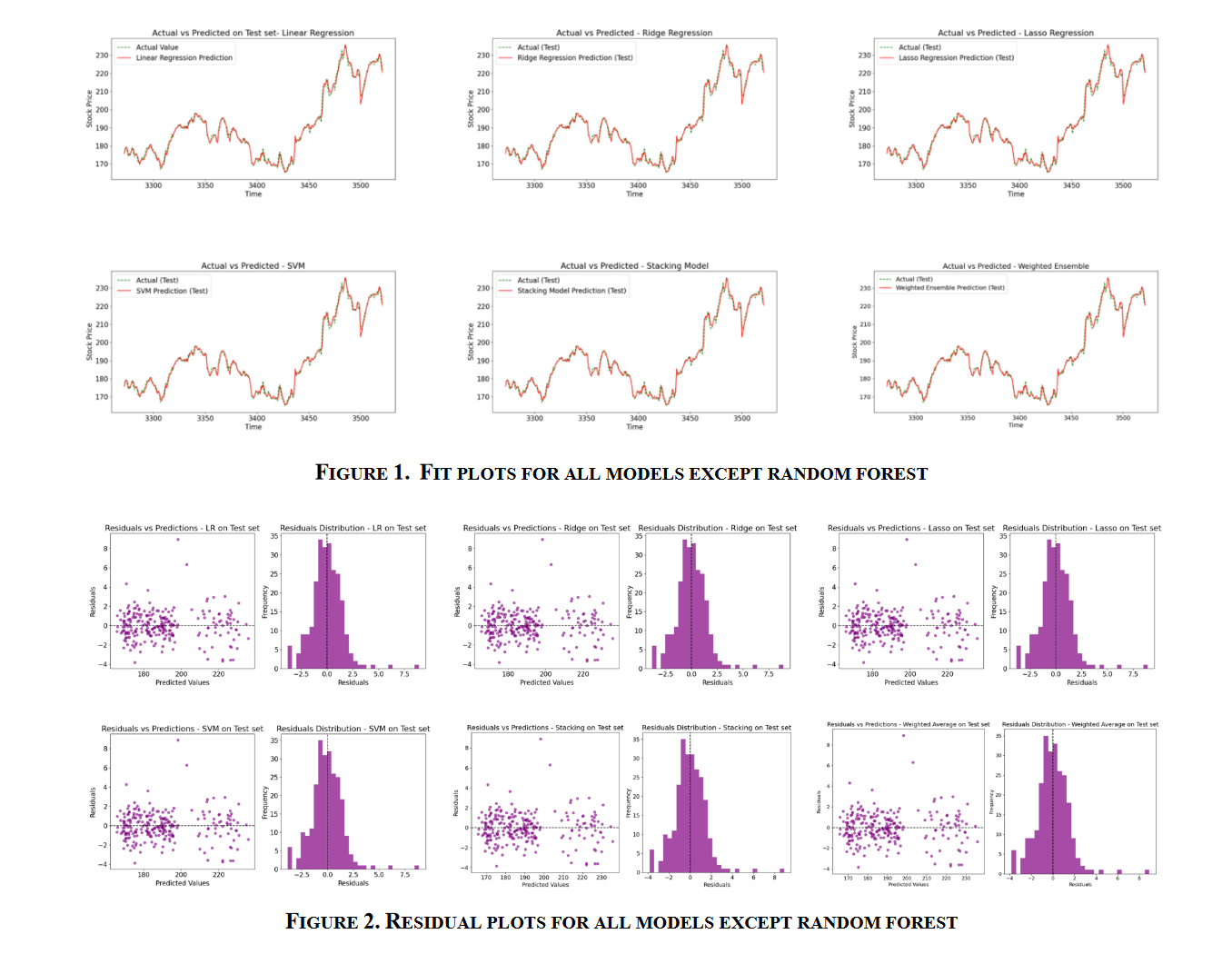

This paper investigates the performance of a variety of machine learning models for Apple stock price prediction, covering linear regression, ridge regression, Lasso regression, SVM, weighted average, stacked model, and random forest methods. The dataset contains daily closing prices of Apple stock for the period from 2010 to 2024, using data from the first 13 years for model training and data from the last year for testing. The study results show that after many times of parameters tuning and testing, all models except Random Forest exhibit good prediction results, with simple models such as linear regression and ridge regression performing particularly well with fewer features, while the Random Forest model exhibits severe overfitting/underfitting problems. This study provides an empirical reference for the application of machine learning in financial time series forecasting, which can help to improve financial forecasting ability and investment decision-making in the future.

Downloads

Metrics

References

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25(2), 383-417.

Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2015). Predicting stock market index using fusion of machine learning techniques. Expert Systems with Applications, 42(4), 2162-2172.

Zhang, G. P. (2003). Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing, 50, 159-175.

Dietterich, T. G. (2000). Ensemble methods in machine learning. In International Workshop on Multiple Classifier Systems (pp. 1-15). Springer.

Xinjie, (2014). Stock Trend Prediction With Technical Indicators using SVM. Stanford University.

Khaidem, L., Saha, S., & Dey, S. R. (2016). Predicting the direction of stock market prices using random forest. arXiv preprint arXiv:1605.00003.

Madge, S., & Bhatt, S. (2015). Predicting stock price direction using support vector machines. Independent Work Report Spring, 45.

Draper, N. R., & Smith, H. (1998). Applied Regression Analysis. John Wiley & Sons.

Hoerl, A. E., & Kennard, R. W. (1970). Ridge Regression: Biased Estimation for Nonorthogonal Problems. Technometrics, 12(1), 55–67.

Hastie, T., Tibshirani, R., & Friedman, J. (2009). The Elements of Statistical Learning: Data Mining, Inference, and Prediction. Springer.

Zou, H., & Hastie, T. (2005). Regularization and Variable Selection via the Elastic Net. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 67(2), 301–320.

Friedman, J., Hastie, T., & Tibshirani, R. (2010). Regularization Paths for Generalized Linear Models via Coordinate Descent. Journal of Statistical Software, 33(1), 1-22.

Vapnik, V. N. (1995). The Nature of Statistical Learning Theory. Springer.

Smola, A. J., & Schölkopf, B. (2004). A Tutorial on Support Vector Regression. Statistics and Computing, 14(3), 199–222.

Breiman, L. (2001). Random Forests. Machine Learning, 45(1), 5–32.

Song, Q., & Xia, S. (2024). Research on the Effectiveness of Different Outlier Detection Methods in Common Data Distribution Types. Journal of Computer Technology and Applied Mathematics, 1(1), 13-25.

Neloy, M. A. I., Nahar, N., Hossain, M. S., et al. (2022). A weighted average ensemble technique to predict heart disease. In Proceedings of the Third International Conference on Trends in Computational and Cognitive Engineering: TCCE 2021 (pp. 17-29). Springer Nature Singapore.

Wolpert, D. H. (1992). Stacked Generalization. Neural Networks, 5(2), 241–259.

Published

How to Cite

Issue

Section

ARK

License

Copyright (c) 2024 The author retains copyright and grants the journal the right of first publication.

This work is licensed under a Creative Commons Attribution 4.0 International License.